Global gold demand hit its lowest level in more than two years in the second quarter amid a weakening appetite for the yellow metal in India and China.

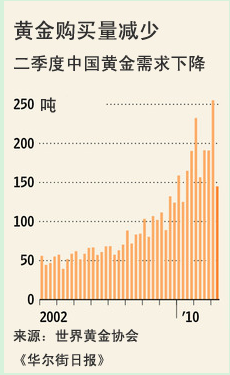

随着印度和中国黄金需求的下降,今年二季度全球黄金需求降至两年多以来的最低水平。

Demand in the period fell by 7% to 990 metric tons from the second quarter of 2011, according to the World Gold Council, an industry group. This is the lowest since the first quarter of 2010.

根据行业组织世界黄金协会(World Gold Council)提供的数据,二季度全球黄金需求降至990吨,同比下降7%,为2010年一季度以来的最低水平。

India and China, the world"s heavyweight gold consumers that together accounted for 45% of second-quarter gold demand, both cut back their purchases of the precious metal amid concerns about growth, according to the council's quarterly report on the gold market, which was released Thursday.

世界黄金协会周四发布的黄金市场季度报告显示,作为全球主要的黄金消费国,印度和中国二季度黄金需求占全球黄金总需求的45%。由于经济增长放缓引发的担忧,两国都减少了黄金这种贵金属的购买量。

The demand from exchange-traded funds that buy gold bars on behalf of their investors was flat, according to the report.

报告显示,交易所交易基金(ETF)的黄金需求与去年同期持平。

'When you have two out of the three pillars of gold demand wobbling, then you can have potential problems' in the form of lower prices, said Jon Nadler, senior analyst with at Montreal bullion dealer Kitco Metals Inc.

位于蒙特利尔的金银交易商Kitco Metals Inc.的高级分析师纳德勒(Jon Nadler)说,当支撑黄金需求的三根支柱有两根已经摇摇欲坠时,你可能要遇到价格下跌的潜在问题了。

Gold futures for August delivery gained $12.40, or 0.8%, to settle at $1,616.10 a troy ounce on the Comex division of the New York Mercantile Exchange. Gold prices are up 3.2% on the year, but off 14.4% from a record $1,888.70 hit Aug. 22, 2011.

纽约商品交易所Comex分部8月交割的黄金期货合约涨12.40美元,至每盎司1,616.10美元,涨幅为0.8%。黄金价格8月同比上涨3.2%,但较2011年8月22日的1,888.70美元的历史最高水平下跌了14.4%。

Excluding central banks and industrial users, gold demand was down 13% to 721.1 tons. Central banks continued their bullion buying spree as they diversify their reserves away from dollars and euros, purchasing 157.5 tons in the second quarter, a record.

剔除央行和工业使用者的需求后,全球黄金需求下降了13%,至721.1吨。为了减少美元和欧元储备、使储备多样化,全球央行仍然在大举购买黄金,第二季度的购买量创下157.5吨的历史新高。

India recaptured the crown as the world's top consumer in the second quarter, after losing out to China for two consecutive quarters. However, India's consumer demand for gold, a metric that combines sales of jewelry, coins, and bars, is down 38% to 181.3 metric tons.

二季度印度重新夺回了世界第一大黄金消费国的地位,此前两个季度,印度的黄金需求皆落后于中国。不过,印度消费者的黄金需求下降了38%,至181.3吨。消费者的黄金需求包括珠宝、金币和金条的销量。

The decline was attributed to the persistently weak rupee, which has kept gold in rupee terms near record highs despite declines in global gold prices.

卢比的持续疲软导致印度消费者黄金需求的下降。尽管全球金价下跌,但卢比的疲弱导致以卢比计价的黄金价格保持在接近历史高点的水平。

'India will continue to be out of the market for a while,' said George Gero, senior vice president with RBC Wealth Management. He said the dry monsoon season has cut into farmers incomes, leaving many buyers with little disposable income.

加拿大皇家银行财富管理公司(RBC Wealth Management)高级副总裁格罗(George Gero)说,印度消费者对黄金的需求将继续保持低迷状态。他说,干旱的季风季令农民收入减少,许多买家可支配收入都微乎其微。

There were bright spots in the demand data. Excluding India and China, global retail investment demand for gold, mostly from Europe, actually rose 16% to 195.2 metric tons.

黄金需求数据中也不乏亮点。除印度和中国外,全球黄金零售投资需求上升了16%,达到195.2吨,其中大多数来自欧洲。

本文关键字: 黄金

免费试听

免费试听

时长 : 29:45 主讲 : 乔迪

时长 : 44:09 主讲 : 徐宸

时长 : 21:15 主讲 : 徐宸

时长 : 21:15 主讲 : 徐宸

时长 : 44:09 主讲 : 徐宸

时长 : 29:45 主讲 : 乔迪

时长 : 15:31 主讲 : 徐新磊

时长 : 18:37 主讲 : 孔令金

时长 : 15:31 主讲 : 徐新磊

推荐阅读

推荐阅读

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开