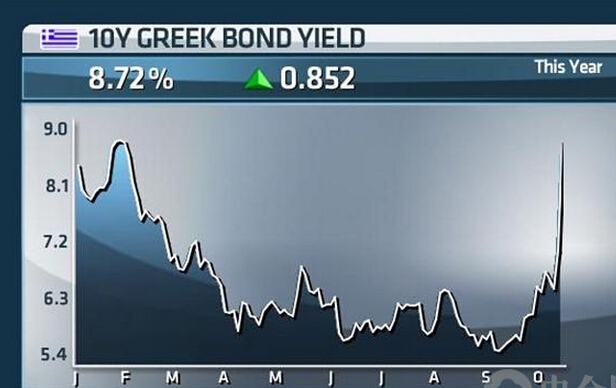

Turmoil across global financial markets and a spikein Greek borrowing costs yesterday reignited fearsabout Europe’s recovery and the structuralproblems left over from the eurozone debt crisis.

全球市场动荡和希腊借款成本昨日大涨,令人再度担心欧洲复苏以及欧元区债务危机遗留下来的结构性问题。

For the first time this year, Greece’s benchmarkbond yields rose above 9 per cent as mountingpolitical instability raised doubts about Athens’ability to sustain its heavy debt burden. Europeancountries hit hardest by the eurozone debt crisis alsosaw their borrowing costs jump at rates not seen for a year.

希腊基准国债收益率周四升至9%以上,这是今年第一次达到这样的高位。目前希腊政治越来越不稳定,加深了市场对于雅典方面能否承受其沉重债务负担的疑虑。受到欧元区债务危机最沉重打击的其它欧洲国家,也看到其借债成本飙升至一年来未见的水平。

Concerns about low global growth kept Wall Street under pressure, but stocks rebounded andUS Treasuries erased gains as James Bullard, St Louis Federal Reserve Bank president, said thecentral bank should consider delaying the end of its asset-purchase programme, known asquantitative easing.

全球增长乏力引发的担忧令华尔街持续承压,但股票出现反弹行情,同时美国国债价格抹去了其涨幅。路易斯联储行长詹姆士•布拉德(James Bullard)表示,美联储(Fed)应考虑延迟终止其资产购买计划——即量化宽松(QE)——的时机。

“Inflation expectations are declining in the US,” Mr Bullard said in an interview withBloomberg News.

“美国的通胀预期开始下降,”布拉德在接受彭博新闻社(Bloomberg News)采访时表示。

本文关键字: 希腊国债收益率再度超过9%

免费试听

免费试听

时长 : 29:45 主讲 : 乔迪

时长 : 44:09 主讲 : 徐宸

时长 : 21:15 主讲 : 徐宸

时长 : 21:15 主讲 : 徐宸

时长 : 44:09 主讲 : 徐宸

时长 : 29:45 主讲 : 乔迪

时长 : 15:31 主讲 : 徐新磊

时长 : 18:37 主讲 : 孔令金

时长 : 15:31 主讲 : 徐新磊

推荐阅读

推荐阅读

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开

第十三届全国人民代表大会第二次会议(the second session of the 13th National People& 39;s Congress)5日上午在人民大会堂开